Overview

Pakistan is still largely a cash-based, informal economy. The majority of transactions are conducted in cash, except for large ones requiring a bank draft or pay order. Several studies suggest that up to 60 percent of the economy is informal, with the majority of local companies, particularly SMEs, undocumented and outside the tax net.

A number of government departments have started to offer services via the Internet. In the private sector, four Pakistani airlines now offer e-ticketing and almost all local banks offer online banking services. This segment of the economy is expected to grow steadily as there are approximately 100 million Internet subscribers in Pakistan, a figure that is expected to growth significantly over the next five years. As per local trade resources, Pakistan is the 46th largest market for eCommerce with a revenue of US$4.2 billion in 2021.

There are also more than 49.2 million Facebook users in Pakistan and several local companies now use social media to promote their products and services. According to the Pakistan Telecommunication Authority (PTA), the number of 3G and 4G users in Pakistan reached 111.38 million by end of February 2022, and the mobile banking sector shows promise.

Current Market Trends

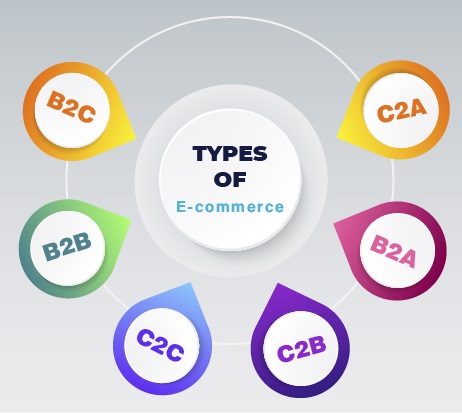

The e-commerce sector has focused mainly on consumer products and accessories. Online customers in Pakistan search for and purchase consumer electronics , make employment queries, receive online education and counseling services, sell/purchase and gather information on vehicles, computers, financial, food and grocessories, and countless other products and services. Consumer choices and the records they generate also produce a trove of data that is used in targetted advertising.

eCommerce Services

Google Chrome is the most popular browser, accounting for 56 percent of total visitors, followed by Microsoft Internet Explorer/Edge (21%). The remaining 23 percent of searches are through Android, Safari, Opera, Opera Mini, UC Browser, Safari and Maxthon respectively.

Online Payment

According to reports, 95 percent of e-companies recieve payments for their online orders via cash-on-delivery. This increases the liquidity requirements for e-commerce companies and also forces them to have dedicated teams that manage cash receipts for the company, thereby raising operational costs. The larger players in the e-commerce space have started to utilize digital payments, and are optimistic that the industry will come together to coax consumers into moving away from cash-on-delivery to online payments. Digital payments also represent a hurdle for Pakistan’s e-commerce sector. While a number of products like EasyPaisa, JazzCash, and uPaisa – which are mobile banks – are available today, none of them have high market penetration. This, coupled with the fact that only 24 percent of the country’s population has a bank account, significantly increases the cost of doing business for e-commerce companies.

In 2021, the State Bank of Pakistan (SBP) launched an indeginous digital payment gateway called “Raast”, to enable individuals, businesses, and government to conduct financial transactions. This payment system was launched with an intention to enable small-value retail payments as well as provide cheap and universal access to all players in the value chain of the local financial industry.

Mobile eCommerce

With the introduction of 3G/4G services, internet penetration has risen rapidly. Internet subscriber growth in Pakistan is averaging over 35 percent per year and total subscribers crossed over 100 million mark. Cheap smartphones, low cost of 3G/4G services and a consumer-goods obsessed middle class has meant that Pakistan’s e-commerce sector is “mobile first”: some e-commerce start-ups claim that over 75 percent of their total business is online.

Major Buying Holidays

E-commerce entrepreneurs enjoy heavy traffic on Pakistani holidays and event season such as Eid-ul-Fitr (April), Eid-ul-Adha (July), Black Friday, New Year and Wedding Season (October through April). Major sporting events can also drive purchases of related equipment and apparel.

Social Media

The introduction of mobile broadband coupled with affordable smartphones has driven the social media use and the popularity of Facebook, Twitter, Skype, and Instagram. Facebook leads social media with more than three billion connections per day and more than 45 million user accounts in Pakistan. Twitter is also fast becoming the preferred social media portal with more than 280 million connections per day. Google, You Tube, and Instagram are also popular.